Synthetic Assets for a Real World

A trustless, distributed, synthetic, real-world representation

OracleHub.io

About Syncomm

SynComm is a decentralized exchange and a platform for synthetic assets. The protocol is designed in a way that exposes users to the underlying assets via synths, without having to hold the underlying asset. The platform allows users to autonomously trade and exchange synths.

The platform allows users to autonomously trade and exchange synthetic assets. It also has a staking pool where holders can stake their SYC tokens and are rewarded with a share of the transaction fees on the SynComm Exchange.

The platform tracks the underlying assets using smart contract off chain price delivery protocols or in-bound price oracles. SynComm allows users to trade synths seamlessly, without liquidity/slippage issues. It also eliminates the need for third-party facilitators.

In addition to access to fungible synthetic assets such as commodities and other crypto assets SynComm is also designed to be a self-service platform for anyone looking to create a synthetic asset, for any non-fungible class of assets that can then be fractionalize, financed, refinanced, insured, traded, and exchanged. The asset owner decides what percentage of the NFT they want to sell at what price “Offer Price”. The NFT is custodied in an (audited) smart contract and ERC20 fractions are issued for it. For a set period the “Offer Period”, buyers can come in and buy fractions at that price. Once all fractions are sold or the “Offer Period” expires, buyers receive the Synth raised from the percentage of the NFT sold, and the buyer gets their respective fractions. The fractions are then listed on a token exchange like Binance or a DEX platform like Uniswap or an OpenSea storefront.

The platform also tracks the underlying NFT assets using inbound off-chain hardware oracles or SHO’s (SynComm Hardware Oracles) that provide trustless data streams to smart contracts.

SNY tokens are used as collateral for the synthetic assets that are minted. This means that whenever synths are issued, SYC tokens are locked up in a smart contract.

Types of Nodes

At this early stage, to secure the network, SynComm will operate more as a non-custodial platform rather than a purely decentralized platform. This nodal hierarchy will consist of...

read more (pdf)

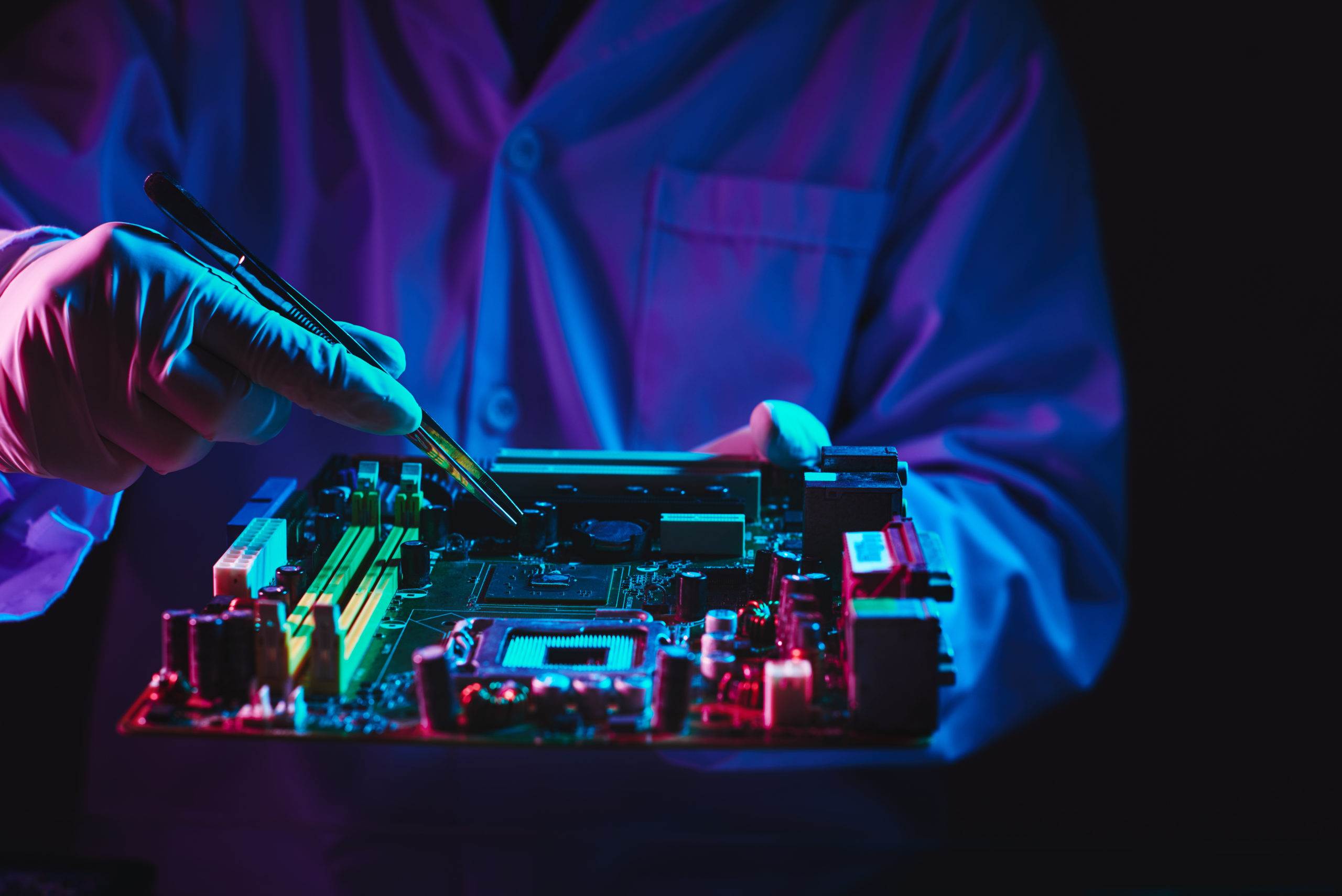

Syncomm Hardware Oracle (SHO)

SynComm hardware oracles are light clients on the SynComm network and are trust-less data feeds to SynComm smart contracts using cryptographic signatures to sign all data an asset produces, proving its source.

Read More (pdf)